Proposed Tax Changes for Tax Year 2023

The closest things to “magic words” when it comes to taxes are deductions and credits. Both help you keep more money in your pocket instead of Uncle Sam’s, but they do so in slightly different ways!

Tax deductions help lower how much of your income is subject to federal income taxes. Some deductions are only available if you choose to itemize your deductions, while others are still available even if you decide to take the standard deduction.

Meanwhile, tax credits lower your actual tax bill dollar for dollar, and there are two types of credits: refundable and nonrefundable. If a credit is greater than the amount you owe and it’s a refundable credit, the difference is paid to you as a refund. Score! But if it’s a nonrefundable credit, your tax bill will be deduced to zero, but you won’t get a refund. That’s still great! Here are some deductions and credits you might be able to claim on your 2023 tax return:

20,000STANDARD DEDUCTION

The standard deduction for a married couple is $27,700, married filing separately is $13,850, head of household is $20,800 and single is $13,850. Additional dependents are $500. If you are over 65 you will receive an additional $1300 added to your deduction.

FILING STATUS:

There are five filing statuses:

*SINGLE

*MARRIED FILING JOINT (MFJ)

*MARRIED FILING SEPARATELY (MFS)

*HEAD OF HOUSEHOLD (HOH)

*QUALIFYING WIDOW(ER) (QW)

SINGLE:

A tax-payer is single if unmarried or separated from a spouse, either by divorce or a separate maintenance decree, on December 31. A widow(er) whose spouse died before 2023 is single unless he meets the test for qualifying widow(er).

MARRIED FILING JOINTLY:

Taxpayers may file jointly if on the last day of the year they are:

*Married and living together,

*Married and living apart, but not legally separated or divorced,

*Separated under an interlocutory (not final) divorce decree, or

*Living in a common-law marriage, if common-law marriage is recognized in the

state where they currently reside or in the state where the marriage began.

If one spouse died in 2023, the survivor can file jointly with the decedent if the couple met one of the above tests on the date of death and the survivor did not remarry in 2023.

*Same-sex marriages. For federal tax purposes, the term spouse includes an individual married to a person of the same sex if the couple is lawfully married under state (or foreign) law, even if the state (or foreign country) in which they now live does not recognize same-sex marriage. However, individuals who have entered into a registered domestic partnership, civil union or other similar relationship that is not considered a marriage under state (or foreign) law are not considered married for federal tax purposes.

HEAD OF HOUSEHOLD:

To qualify as Head of Household the tax payer must meet all of these test:

*The taxpayer is not married at the end of the year ( exception: Married taxpayers can qualify as HOH but meeting the test for considered unmarried.

*The taxpayer paid more than half the costs of keeping up his home.

*The home was the principal residence for more than half the year for either of the following:

The taxpayer’s qualifying child

The taxpayer’s qualifying relative who is the taxpayer’s dependent

*The taxpayer is a U.S. Citizen or resident during the entire year.

CHILD AND DEPENDENT CARE CREDIT

In the tax year 2023, if you earn $15,000 or less you can qualify for the maximum $1,050 credit for one qualifying person and $2,100 for two or more qualifying persons. This is no longer a refundable credit. You can check here to see if you qualify for the Child and Dependent Care Credit.

STUDENT LOAN INTEREST DEDUCTION:

Taxpayers can deduct up to $2500 of interest paid on qualified education loans for college or vocational school expenses as an adjustment to income (above-the-line) (IRC 221).The deduction is available for interest on qualifying loans for the benefit of the taxpayer or the taxpayer’s spouse or dependent at the time that the debt was incurred. Read more at the IRS.

EARNED INCOME TAX CREDIT

EITC, in 2021, had a refundable credit for low and moderate income workers, but this relief has ended. For the tax year 2023, if you are single with no children and earned less than $16,480 you can get a maximum credit of $560. You can check here to see if you qualify for the Earned Income Tax Credit.

Once again, the IRS will be holding the Earned Income Credit Returns until mid-February before they are released.

CHILD TAX CREDIT

For tax year 2023, the Child Tax Credit is $2,000 per child or dependent and only available for children under the age of 17. In tax year 2023, the credit is only partially refundable to some low-income parents. Advance payments are no longer in effect.

CHARITABLE DEDUCTIONS

The expanded charitable contribution benefits the IRS offered have ended and the 6% AGI limit is back in for 2023. To be able to claim qualified charitable donations for tax year 2023, you must itemize your deductions.

RETIREMENT INCOME

The CARES Act also affects a few things related to retirement income. The new age for the required minimum distribution (RMD) has gone from 70-1/2 to 72. This affects anyone born after 2019. This allows seniors to skip the RMD in 2023 with no penalty. Also the age that you can contribute to a Traditional IRA has been raised from 70-1/2. If you are having a baby or adopting a child you may take a distribution of up to $5000 without having to pay the 10% penalty.

The individual 401(k) contribution limit, for tax year 2023, increased to $20,500. Anyone over the age of 50 can contribute an additional $6,500. For tax year 2023, the total contribution limit (this includes any employer contributions) is $61,000 and if your are over 50 it is $67,500.

For SIMPLE IRAs, contributions for 2023are $14,000 and if you are over 50 you can contribute an additional $3,000.

If you have an IRA you can continue contributing into it for the tax year 2023 up until April 18, 2023.

The IRS has increased the income threshold for the Saver’s cred for 2023 for single filers up to $1,000 and $2,000 for married filing join filers as long as you contribute to a retirement account and meet the AGI requirements. For tax year 2023, the AGI must not be over $34,000 for single, $68,000 for married filing joint, and $51,000 for head-of-household filers.

TAX BRACKETS

The tax brackets were raised significantly so that you will stay in a lower tax bracket longer. Here is a breakdown:

IRS tax inflation adjustments for tax year 2022

REPORTING CRYPTO AND NFT TRANSACTIONS

For tax year, 2023, the IRS is cracking down on tacking cryptocurrency trades and sales. When there’s a trade, sell or item purchased with cryptocurrency it triggers a taxable event which is reported to the IRS. Since cryptocurrency is taxed just like property, it makes it subject to short-term or long-term capital gain taxes which are reportable to the IRS, which also means any cryptocurrency losses are to be reported which can help offset any gains. The IRS will flag any gains you have, but if you don’t report any losses you have that can help lower your tax burden, the IRS will not adjust your return on your behalf.

If you traded or sold cryptocurrency at a loss, you can report your capital loss and help to reduce any tax liability. The same goes for NFTs.

THIRD-PARTY APPS REPORTING PAYMENTS TO THE IRS

The self-employed and freelancers have always been required to report their earnings to the IRS. Under the new law, which took effect January 1, 2023, third-party apps, such as Cash App, Zelle, Venmo, PayPal and others, are required to report to the IRS any transactions paid in 2023 that exceeds a minimum threshold of $20,000 in aggregate payments or 200 transactions.

You still need to report any earnings as usual since the IRS will be able to verify the amounts you report against the transactions in third-party apps. Each third-party app will be issuing you a 1099-K form which should make reporting your income a lot easier.

Any money you have gifted to your children is safe from taxes. Only your earnings sent through the third-party apps are subject to being reported and taxed.

The third-party apps will need to confirm you tax information (employer identification number (EIN), individual tax identification number or your Social Security number. Most business owners have an EIN, but if you are a sole proprietor or individual freelancer or even a gig worker you will need to provide an ITIN or social security number.

TYPES OF INCOME REPORTING FORMS

- 1099-K: Reports nonemployment income for anyone who uses online platforms, third-party apps or payment card processors for payments made for goods or services. It only reports on the “gross” amounts and not “net” transactions.

- 1099-INT: Reports most payments of interest income

- 1099-MISC: Documents the earned income you made as an independent contractor via direct deposit, check, or cash.

- 1099-R: Income that comes from an IRA distribution or a pension

TAX REFUNDS

If you were one of the thousands of taxpayers whose refund was held up, then you probably received interest on your refund amount. That amount is taxable interest and must be reported. The IRS will send you a 1099INT sometime in mid to late January to advise you of the amount you need to report.

HEALTH SAVINGS ACCOUNT

These accounts allow you to put away pretax or tax-deductible money and have it grow free of taxes. You can take a tax-free withdrawal to cover qualified health expenses. This year, you can save up to $3,550 if you’re an individual with self-only health coverage. That’s up from $3,500 in 2019. Account holders with family plans can save up to $7,100 in this account, up from $7,000 in 2019

NEW CREDIT – QUALIFIED BUSINESS INCOME

There is a new credit called QBI (Qualified Business Income) for each trade, business or farm that is showing a profit from their business activity. The credit is calculated by percentage of the amount of net income. The credit is subject to phase-outs and limitations based on total income.

MOVING EXPENSE DEDUCTIONS:

Only military changing duty stations may deduct moving expenses.

ALIMONY DEDUCTION:

Starting after 2018, the deduction for alimony paid is no longer deductible to the payer or reportable by the recipient. Before 2018 the law is the same, however the date of divorce must be included.

EDUCATION CREDITS:

The Education Credits , Lifetime and American Opportunity and Tuition & Fees Deduction are still in effect with certain phase out levels.

TAX DEADLINE

Tax Day is Friday, April 18, 2023. You must file your 2023 tax returns by this date! Did you have a wild year in 2023? In that case, working with a tax pro is a smart move.

HELPFUL HINTS

If you are having your return done professionally you will need to bring your prior year return, photo id and social security cards for everyone on the return.

CHECK YOUR TAX PREPARER’S QUALIFICATIONS:

All paid tax preparers are required to have a Preparer Tax Identification Number or PTIN. Paid preparers must sign return and include their PTIN as required by law. The preparer must also give you a copy of the return.

IDENTITY PROTECTION:

If you want to make sure your identity is protected, you may apply for an Identity Protection Personal Identification Number that will be used to protect your return.

W-4 INFORMATION:

Each Employee needs to fill out a new W-4 with their employer for 2024.

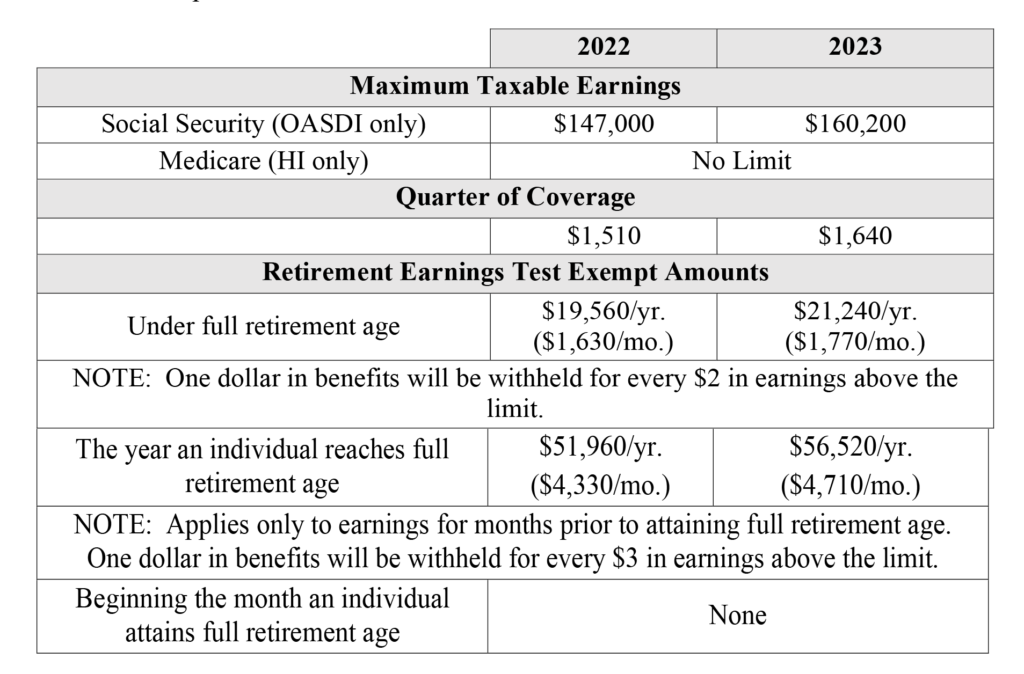

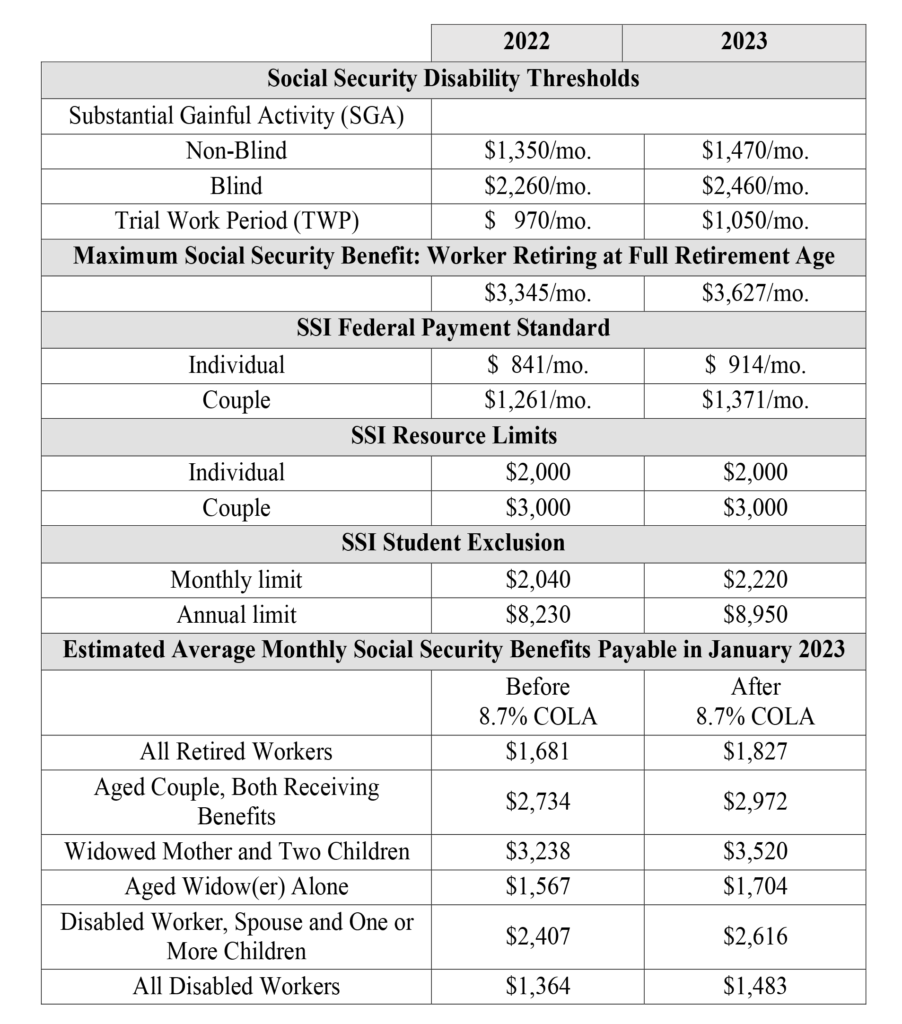

SOCIAL SECURITY 2023 CHANGES

In 2023 Social Security and Supplemental Security Income (SSI) will receive an 8.7% COLA increase. The Tax Rate for an employee in 2023 is 7.65% and for Self-Employed is 15.30%. The 7.65% tax rate is a combination for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is

1.45% on all earnings. Also, as of January 2013, individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent in Medicare taxes. The tax rates shown above do not include the 0.9 percent.

Please note: This is only a short list of some of the new tax rules for 2023. Please spend time with your tax preparer and learn the rules at IRS.GOV so you and your advisor are knowledgeable about qualifying expenses, eligible purchases, contributions, gifts, etc., so you can reduce your tax burden.

What is the 1099-K reporting threshold for 2023?

This means that for the tax year 2023, payment apps and online marketplaces will only be required to send Forms 1099-K to taxpayers who receive over $20,000 and have over 200 transactions.

Why is LLC gaining popularity?

Another reason that a single member, member managed LLC is so popular is that it is

the easiest business form to maintain. It does not require the same formality of

conducting annual meetings and maintaining annual minutes, like a corporation

requires.

What are 3 disadvantages of an LLC?

The Disadvantages of the LLC Business Structure:

- A major disadvantage of an LLC is that owners may pay more taxes….

- It can be harder to attract investors with an LLC structure….

- There tend to be high filing and renewal fees associated with forming and

maintaining an LLC.

What is the Boi rule for FinCEN?

This Access Rule follows the final BOI Reporting Rule FinCEN issued on September 30,

2022, which requires certain corporations, limited liability companies, and other similar entities created in or registered to do business in the United States to report to FinCEN information about themselves, their beneficial owners.

Who is exempt from beneficial ownership rule?

Subsidiaries of certain exempt entities, including larger operating companies, public companies, regulated entities such as banks (but not MSBs), and the exempt private equity and venture capital entities, are also exempt from BOI reporting, provided in each case that the subsidiary’s ownership interests are controlled.

Who must file beneficial ownership report?

The beneficial ownership rule applies to two types of businesses: Domestic reporting companies – These are corporations, limited liability companies (LLCs) and other entities created by filing with a secretary of state or similar office under the law of a state or Indian tribe.

What is the purpose of BOI reporting?

BOI reporting is a new requirement created by the Corporate Transparency Act (“CTA”), which became law in 2021. BOI reporting aims to provide the government with resources to crack down on anonymous shell companies used by money launderers

and criminals.